I was reading a paper by a respected industry body that started by flagging head fake KPIs. I love that moniker, head fake.

Likes. Sentiment/Comments. Shares. Yada, yada, yada.

This is great. We can all use head fake metrics to calling out useless activity metrics.

[I would add other head fake KPIs to the list: Impressions. Reach. CPM. Cost Per View. Others of the same ilk. None of them are KPIs, most barely qualify to be a metric because of the profoundly questionable measurement behind them.]

The respected industry body quickly pivoted to lamenting their findings that demonstrate eight of the top 12 KPIs being used to measure media effectiveness are exposure-counting KPIs.

A very good lament.

But, then they then quickly pivot to making the case that the Most Important KPIs for Media are ROAS, Exposed ROAS, “Direct Online Sales Conversions from Site Visit” (what?!), Conversion Rate, IVT Rate (invalid traffic rate), etc.

Wait a minute.

ROAS?

Most important KPI?

No siree, Bob! No way.

Take IVT as an example. It is such a niche obsession.

Consider that Display advertising is a tiny part of your budget. A tiny part of that tiny part is likely invalid. It is not a leap to suggest that it is a big distraction from what’s important to anoint this barely-a-metric as a KPI. Oh, and if your display traffic was so stuffed with invalid traffic that it is a burning platform requiring executive attention… Any outcome KPI you are measuring (even something basic as Conversion Rate) would have told you that already!

Conversion Rate obviously is a fine metric. Occasionally, I might call it a KPI, but I have never anointed it as the Most Important KPI.

In my experience, Most Important KPIs are those that are tied to money going into your bank account.

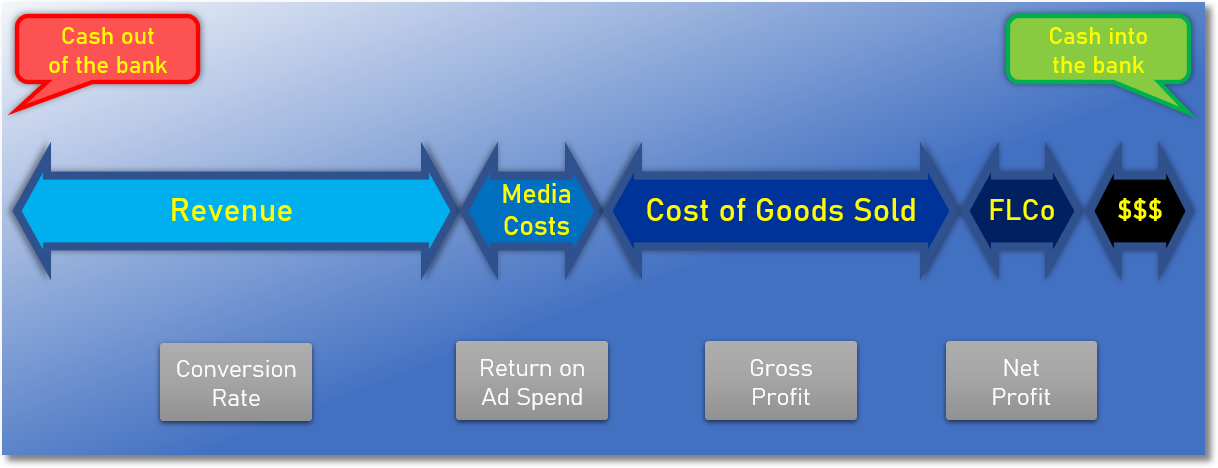

The paper from the respected body made me open PowerPoint and create a visual that would make the case for never identifying Conversion Rate or ROAS the Most Important KPI in your company / practice of analytics.

We expect greatness from our work, let’s focus on great KPIs.

The Money In-Out Continuum | Intro.

When I think of importance, I have five elements in mind.

Let’s identify them first.

To make money, you have to spend money. The law of God.

That’s the red box on your left.

Revenue is what the customer will pay for a product or a service. It is a range above because some products and services you sell for more, others for less.

Media Costs is the amount you have to spend on advertising (a category that also includes your Owned and Earned efforts – after all SEO, Email, Organic Social all cost money).

Hopefully, you spend less on acquiring the order than the revenue you earned. Hopefully. 🙂

Obviously, whatever you sell is not free to you.

Cost of Goods Sold (CoGS) is the amount it costs you to manufacture the product or the service.

As an example, revenue from selling an iPhone is approx. $1,099 and the CoGS is approx. $490. (Source: Investopedia.)

But. Wait. $609 is not all Profit. There’s more to account for.

Fully Loaded Costs (FLCo) contains the costs associated with salaries of human and robotic employees, agency fees, depreciation associated with building, free doughnuts on Fridays for all employees, credit card processing fees, discounts, and the long laundry lists of things that goes into producing the product/service that you sold to earn revenue.

I’ve represented FLCo (I’m pronouncing that as flock, what do you think?) as a smallish bar above, I don’t need to stress just how big it can be. Hence, crucial to measure and account for.

$$$ – something close to Profit – is the money left over that will go into your bank account.

Money at last. Money at last. Thank God almighty, we have money at last!

🙂

The Money In-Out Continuum | KPIs.

Now that we have a common understanding of the elements that form the money in-out continuum, we can layer in what it is that we understand when we measure every day metrics — and the ones anointed Most Important KPIs by the respected industry group.

Let’s lay out the depth of what each KPI measures on our continuum.

Conversion Rate is a fine metric. A junior Analyst – even a budding reporting-focused new hire – should be watching it.

But. As illustrated above:

1. It is very, very, very far from the green, and2. It does not have any sense of what it cost you to get that conversion!

You can, literally, go bankrupt increasing your Conversion Rate.

(Hence, at the very minimum, pair up Conversion Rate with Average Order Value to get an initial whiff of doom.)

Conversion Rate is not a Most Important KPI.

Return on Ad Spend (ROAS) is an ok metric.

It is typically computed by dividing the Revenue from Advertising by the Cost of Advertising (a.k.a. Media Costs). You times that by 100, and you get a ROAS %.

ROAS only sucks less. It remains very, very, very far away from the green. Additionally, by aggregating products/services into lumpy groups, it can give a misleading sense of success.

[Disclosure: I profoundly dislike ROAS — even hate it — for, among other reasons, driving a disproportionate amount of obsession with ONLY Paid Media by CMOs when Paid Media typically delivers a minority of the incremental business revenue. Bonus Read: Attribution is not incrementality.]

Gross Profit is revenue minus Media Costs minus CoGS.

Now, you have yourself a KPI! Not yet the Most Important KPI, but a KPI nonetheless.

In the past, I’ve recommended using Custom Metrics in tools like Google Analytics to compute Gross Profit. You can do this using an aggregate % number that you can lop off for CoGS. At the very minimum, your Traffic Sources report does not have to stop at Revenue (misleading much?).

With Google’s Data Studio, you can actually bring item level CoGS in and easily compute Gross Profit for every single order you get.

It. Will. Change. Your. Life.

Net Profit then is revenue minus Media Costs minus CoGS minus FLCo.

Finally, you have something super cool.

You can work with your Finance team to get FLCo. You’ll get a different number for your Owned, Earned, Paid media strategies. You’ll have a number that’ll accommodate for a sale that might have happened on your website vs. retail store vs. placed on website but picked up on retail, etc.

You can build this into Google’s Data Studio if you like. Or, the Business Intelligence tool of choice used by your company.

Net Profit totally qualifies for the Most Important KPI tag.

It helps identify how much money you created that is going into the bank, and what it is that you did exactly to create that money.

Yep. Understanding that will deliver a transformative impact on your business.

I’ll go out on a limb and say that it will also shock your CMO.

The Money In-Out Continuum | The Problem.

I say this with some confidence that none of your reports for digital, and barely any reports for the entire business, currently report on either one of the above two Most Important KPIs.

Why?

Simple. You are using Adobe Analytics or Google Analytics or some such tool, and they have no built-in concept of 1. Media Costs 2. CoGS, and 3. FLCo.

Sure, if you connect Google Analytics to your Google Ads account, #1 becomes easy. You have Media Costs. But, in addition to Google, you are advertising on a ton of other channels and getting all those costs is a pain – even when possible.

Obviously, digital analytics tools have no concept of #2 (CoGS) or #3 (FLCo).

You are stuck making poor business decisions, in the best case scenario, at stage two of the Stages of Savvy.

This is not enough.

To build a strategy to address this gap in your analytics strategy… My recommendation is to break out of the limitations that your digital analytics tools, and shift to your business intelligence tools (start with exhausting the features Data Studio provides you with for the magnificent cost of zero dollars – lower FLCo!).

Recognize that Analysis Ninjas live at stage 3, and they truly come into their own when they get to stage 4.

Is this true for you? Does your analytical output include Net Profit?

By a staggering coincidence, Analysis Ninjas who live in stages 3 and 4 also have long, productive, well-compensated careers! Because getting there is hard, AND it requires building out a wide array of cross-functional relationships (always crucial when it comes to annual performance reviews!).

#liveinstage4

The Money In-Out Continuum | The Most Important KPI.

Obviously, the most important KPI is the one you are not measuring.

Customer Lifetime Value (CLV) is the sum of Net Profit earned from a customer over the duration they are your customer.

Say I buy the Pixel 1 phone from Google, and Google makes $50 Net Profit from that sale.

Then, I buy the Pixel 2, Pixel 3a, and Pixel 4a. Google makes $60, $60, and $60 Net Profit (they save on advertising costs to me, which translates into higher profit).

Then, for reasons related to innovativeness, I switch to Samsung and buy a Z Flip 3 (great phone!).

My CLV for Google is: 50+60+60+60 = $230.

I originally converted to buying a Pixel 1 after typing best android phone into Bing.

Analytics tools, configured right, with analysis done by Stage 4 Analysts, will show a Net Profit of $50 driven by Bing.

Except, it is $230.

Cool, right?

So. Why don’t we all calculate CLV every day and every night, and then some more of it on the weekend?

Because it is hard.

Go all the way back up and reflect on why is it that we are satisfied with Conversion Rate or ROAS vs. Gross Profit?

Because it is easy.

It is so hard to get to Gross and Net Profit.

Then, to be able to keep track of that same person (me, in the above Pixel example). Then, wait for me to churn so that you get my CLV. Oh, and remember to have systems interconnected enough to keep track of every touchpoint with me to ensure you attribute accurately.

It is hard.

Of course, you don’t have to do the computation for every individual. You can do it by micro-segments (like type people, same geo, age groups, products, etc. etc.). You can do it in aggregate.

Sadly, none of these is easy.

Hence. You don’t do it.

No matter what CLV zealots will tell you.

If they make you feel bad. Don’t feel bad.

My advice is twofold:

1. Keep your primary quest to get to stage 4 (Net Profit) because the quality of your insights will improve by 10x.2. (If you don’t have it already) Create a long-term plan to understand the lifetime value of a customer for your company.

Execute that advice in that order, and you’ll get to the global maxima faster.

As you contemplate your strategy for #2 above, my dear friend David Hughes helped write one of my favorite posts on this blog: Excellent Analytics Tip #17: Calculate Customer Lifetime Value.

Read it. Internalize the recommendations. Download the detailed lifetime value model included in the post, and jumpstart your journey.

#CLVFTW!

Bottom Line.

It is unlikely that any of you reading this blog on advanced analytics is measuring a head fake metric. You realize the futility already.

I also believe that you and I can do more to move beyond stage 1 and stage 2 of the stages of savvy. And, I hope I’ve encouraged you to do that today. It is so worth it.

I believe almost all of us can do more to be on a CLV journey — but not at the cost of losing focus in stages 3 and stage 4.

Let’s get to it!

As always, it is your turn now.

Via comments, please share your critique, reflections, tips and your KPI lessons from the front lines of trying to drive material business impact. What do you disagree with above? What has been the hardest nut for you to crack in your career?

More Stories

Creative Business Ideas That Will Inspire Your Next Move

Business Ideas You Can Start from Home in 2024

5 Innovative Business Ideas to Try Right Now