5 yrs ago, three corporations with some of the most prominent economic advisers in the information field — Morgan Stanley, Merrill Lynch and UBS Financial Companies Inc. — decided to rein in their mass recruiting of fiscal advisers working at competing companies.

It was a higher-charge, large-hazard small business tactic that numerous senior wealth administration executives on Wall Avenue regarded as a clean the expense of recruiting was similar to a sort of benign, required evil to contend as a wirehouse.

As an alternative, Morgan Stanley, Merrill Lynch and UBS made the decision to travel their advisers to get additional consumer property. The corporations centered on strengthening adviser technological innovation, bettering economic preparing to consist of banking and lending, and incentivizing their latest hordes of 1000’s of economic advisers to provide in new shoppers and a bigger share of clients’ belongings.

Rapidly forward to the conclusion of 2021, and wealth management organizations throughout Wall Street were awash in document revenues and earnings. The change in method from fifty percent a ten years back has clearly worked for these 3 companies, even though many advisers remain unsatisfied about upsetting the outdated process. A cutback in recruiting perhaps meant a smaller market for their providers.

THE SWEET Place

At Morgan Stanley, Merrill Lynch and UBS, setting up a community of 1000’s of money advisers is no extended just about increasing head rely — now the true sweet location for these firms, as measured by overall head rely and once-a-year profits per adviser, is boosting income per adviser and incorporating web new belongings each individual quarter.

How considerably wirehouses have distanced themselves from boasting about recruiting and adding masses of advisers is proven really starkly in their reporting to the community every quarter.

Very last spring, Morgan Stanley stopped releasing its quantity of advisers, a crystal clear crack from sector norms, leaving the current market to guess how a lot of essentially perform there. Merrill Lynch Prosperity Management now mushes collectively all the licensed persons under its roof, as if to sign that a financial institution broker at Financial institution of The us is no unique than a wealth manager at Merrill Lynch or a contact heart adviser at Merrill Edge. At UBS, the number of financial advisers is buried in statistical disclosures just about every quarter, most not too long ago on website page 16 of 104.

By distinction, LPL Economical, the premier unbiased broker-dealer with far more than 20,000 registered financial investment advisers and brokers, is in the small business of recruiting and slaps its monetary adviser head count on the entrance web page of its quarterly reviews.

In January, Morgan Stanley Chairman and CEO James Gorman was asked by an analyst all through an earnings conference connect with to explain what was driving the firm’s great natural and organic development. How substantially arrived from retaining economic advisers versus recruiting them?

Morgan Stanley, Gorman observed, has simply set its reliance on recruiting in the rearview mirror. At the wirehouses, recruiting hinged on paying big bonuses, usually two to a few moments an adviser’s once-a-year revenue, to expert economical advisers. They then labored the bonuses off about time, commonly over 7 or 9-12 months durations.

“It’s not a very simple reply mainly because in the aged days, it was very simple,” Gorman explained. “It was a perform of funds that you dropped by financial advisers leaving and revenue you obtain by recruiting economic advisers.”

“And of course, which is a form of sorry way to operate a small business,” he said. “It in essence settles your P&L for the upcoming 9 a long time to buy a tiny little bit of joy in the close to expression. Luckily, we’ve outgrown that.”

If the significant corporations don’t need to have to recruit economic advisers, what’s the up coming step to catch the attention of, create and keep major monetary adviser expertise?

10 many years ago, the selecting of money advisers at the wirehouses experienced a hammer and tongs sense and methodology large bonuses acquired major advisers, and heaps of them. Today, employing advisers, schooling them and hanging on to them, as properly as selectively recruiting them, are a lot a lot more nuanced endeavors.

For case in point, right after hunkering down on choosing advisers in the course of the pandemic, Merrill Lynch is the moment once more on the lookout to bolster the dimension of its thundering herd. This calendar year, it’s concentrating on far more young fiscal advisers with confined practical experience in the business and, far more selectively, skilled advisers exterior main metropolitan markets. UBS has been targeted on selecting personal bankers.

Acquisitions, a moribund market place just after the chaos of the credit score disaster, are as soon as once again in vogue as an engine for advancement. Morgan Stanley not too long ago acquired ETrade and Eaton Vance, even though UBS this yr explained it was attaining robo-adviser Wealthfront Corp.

“Head count is not a benchmark for accomplishment any more.”

Dennis Gallant, senior analyst, Aite-Novarica Team

Merrill Lynch has crafted a tactic of employing advisers that has four entry factors, with recruiting knowledgeable monetary advisers just a person of individuals.

The plan ranges from hiring faculty graduates with no practical experience who come to be trainees to selectively recruiting experienced fiscal advisers in marketplaces that the organization is hunting to for better access, Andy Sieg, president of Merrill Lynch Prosperity Administration, claimed in a modern interview on the InvestmentNews Podcast.

“It’s a diversified strategy to building our adviser workforce in the decades ahead,” Sieg reported.

“Big firms employed to seek the services of advisers so they would just have the figures, and elevate and decrease head rely for quarterly or yearly reports and meetings,” said Dennis Gallant, senior analyst at Aite-Novarica Team. “Those metrics have evidently modified.”

“Head depend is not a benchmark for results anymore at all those three wirehouses,” he stated. “It’s nonetheless key for unbiased broker-dealers but it’s significantly less significant at the wirehouse companies. They are not talking about it any more, even however they frequently get requested about it during the earnings phone calls.”

“The massive firms put in the previous decade reducing the very low-creating money advisers and now want a next technology of property-grown monetary advisers that will be tied to the financial institution,” Gallant mentioned. “They really do not want to deal with the headache of the adviser threatening to leap to a breakaway or independent business if he’s not treated the way he thinks he should really.”

BREAKING PROTOCOL

Weary of acquiring to pay back 6-figure bonuses to switch some of their most productive brokers who left for rivals following the money disaster, Morgan Stanley and UBS upended the prosperity management sector in the vicinity of the close of 2017 by withdrawing from an arrangement recognized as the protocol for broker recruiting, which makes it a lot easier for monetary advisers to go away 1 agency to be part of one more. The settlement had been founded in 2004.

The go, initially by Morgan Stanley and then by UBS, was a decided hard work to hold on to much more of their money advisers.

Less than the protocol, corporations agree that they will not enforce restrictive covenants, this kind of as noncompete and non-solicitation provisions, in employment contracts as extensive as the departing brokers restrict the shopper information they take with them to their new employer and concur not to get in touch with their clients until just after they leave. They may possibly go away with a client’s identify, deal with, cellphone variety, e mail address and account title.

Merrill Lynch remained in the settlement, but lower again on recruiting nevertheless, pursuing a multipronged strategy to improve its business, which include building a new pay back system deemed the “growth grid” that goosed its advisers to chase much more new homes.

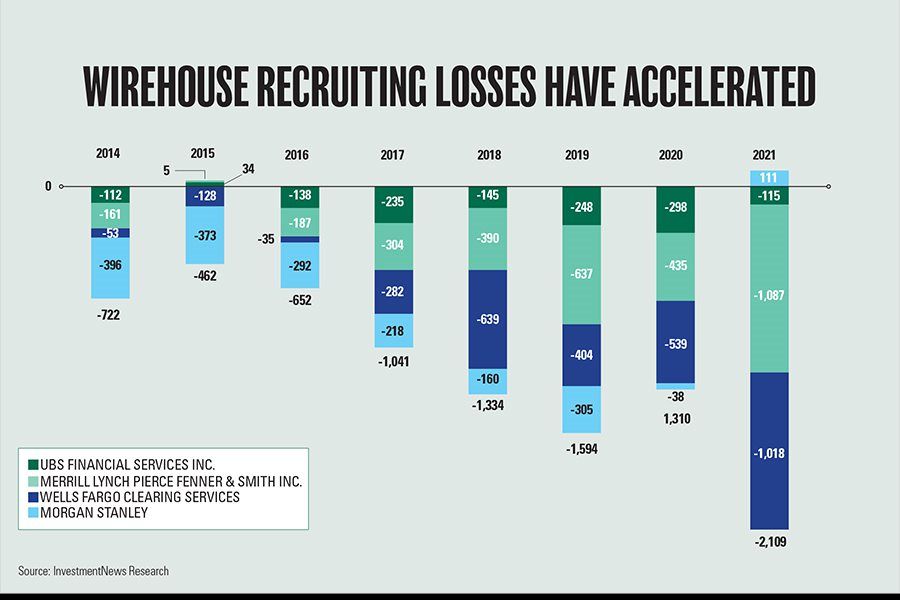

The fourth and final-standing wirehouse company, Wells Fargo Advisors, also remains in the protocol and has continued to recruit financial advisers by paying bonuses. But it has traveled a rocky highway considering that 2017, when the scandals emanating from its guardian, Wells Fargo & Co., commenced to spill above to Wells Fargo Advisors, which has found a drop of thousands of advisers in excess of that time, some from displeasure with the financial institution, some from retirement.

Tearing up the broker protocol didn’t happen in a vacuum. Indeed, it was component of concentrated methods at both of those Morgan Stanley and UBS to maintain brokers and advisers tied to the firms, industry executives said. That kicked off in the spring of 2016, when UBS claimed it was pulling back again from recruiting to emphasis far more on products and services and know-how for its existing workforce.

THE PAYOFF

For Morgan Stanley, UBS and Merrill Lynch, the transfer absent from recruiting, the moment regarded as the lifeblood of a brokerage firm, appears to have paid out off. The S&P 500 regularly hit history highs all through 2021, benefitting brokerage companies and banking institutions immensely.

In 2021, Morgan Stanley and its close to 16,000 fiscal advisers brought in document internet new belongings for the 12 months of $437.8 billion, for an once-a-year progress price of 11%, in accordance to the firm. All through a meeting contact in January with analysts, Gorman known as that rate of advancement “freakish.”

UBS international wealth management Americas, with 6,218 advisers at the conclude of past year, sent a pretax financial gain of $2 billion for 2021, which was a report and marked a 47% increase calendar year more than year, in accordance to the business. The performance was supported by an 18% boost year about 12 months in earnings for each adviser and record personal loan volume of $92 billion, according to the business.

And Merrill Lynch posted report earnings of $17.4 billion in 2021, a 14% yr-over-yr boost. Client balances reached a record $3.2 trillion by the conclude of December, a different 14% annual boost. The term “record” was utilised 25 instances in a summary produced to reporters in January of Lender of The usa and Merrill Lynch’s 2021 prosperity management highlights for last calendar year. Bank of The usa/Merrill Lynch documented 18,846 advisers at the end of past year, which includes Merrill, Lender of The united states private lender and consumer investments.

”When Morgan Stanley withdrew from the broker protocol in 2017, a significant part of the firm’s reasoning was to get department administrators focused on advisers using new technologies somewhat than chasing probable recruits at breakfast or lunch,” said Jed Finn, chief operating officer at Morgan Stanley Wealth Management.

“When you are rolling out billions of bucks of technologies for the advisers and attempting to get them to adapt, you will need leadership and department supervisors to be around and centered on it,” Finn explained. “Recruiting is 1 software in the package. We’re now viewing a significant move of sales opportunities in the self-directed business enterprise, for example,” he added, referring to traders at the lately obtained ETrade who might want to work with a money adviser in the long run.

The times of recruiting reigning supreme at the wirehouses are long long gone.

“It’s additional correct than at any time — at the wirehouses, it is all about locking in the present-day purchasers and adviser teams and tactics,” said Danny Sarch, a veteran industry recruiter. Pushing lending goods and choice investments that are special to that agency are section of the strategy.

“They want customers to be stickier to the company,” Sarch claimed. “The method is, tie the purchaser to the business so there is loyalty to the institution instead than the individual adviser.”

More Stories

5 Common Finance Mistakes and How to Avoid Them

Simple Finance Tips for Better Money Management

The Best Finance Hacks to Save More Money