Financial markets rarely move in isolation. For Dutch traders navigating today’s interconnected world, understanding the interplay between asset classes is no longer optional—it is essential. Whether you’re monitoring the euro’s reaction to policy shifts, gauging sentiment through equity indices, or using derivatives to hedge risk, cross-market correlations can provide valuable insights for smarter positioning.

This holistic perspective allows traders to anticipate movements, diversify effectively, and build more resilient strategies. By combining forex, stocks, and derivatives like options, Dutch investors can create a toolkit that adapts to changing conditions while maximizing opportunity.

Why Cross-Market Correlations Matter

Global markets are interwoven by capital flows, central bank policies, and investor psychology. A currency pair such as EUR/USD can react strongly to developments in U.S. equities, while Dutch stocks listed on the AEX may shift in response to global risk sentiment reflected in forex volatility.

For example, when the euro strengthens significantly, export-heavy companies in the Netherlands may face pressure on earnings, which in turn affects stock valuations. Likewise, equity sell-offs can spark safe-haven flows into certain currencies or commodities. By tracking these correlations, traders gain a forward-looking lens instead of relying solely on price charts for one asset class.

This interconnectedness underscores why focusing on a single market may leave blind spots. Cross-asset awareness provides context, highlights risks, and uncovers opportunities that isolated strategies might miss.

The Role of Forex for Dutch Traders

Forex is the heartbeat of global finance. With over $7 trillion traded daily, currency markets set the tone for cross-border trade and investment. For Dutch traders, forex offers more than speculation; it provides signals that ripple across other markets.

For instance:

- Monetary policy divergence: When the European Central Bank (ECB) takes a dovish stance while the U.S. Federal Reserve tightens, the euro may weaken against the dollar, influencing Dutch multinationals with U.S. operations.

- Safe-haven dynamics: During geopolitical stress, currencies like the Swiss franc or Japanese yen often strengthen, reflecting risk aversion that can spill over into equity markets.

- Commodity currencies: Dutch traders watching energy-related firms may track correlations with currencies like the Canadian dollar or Norwegian krone, both tied to oil prices.

Forex thus acts as a barometer of global macroeconomic conditions, providing a foundation for cross-market strategies.

Stocks as Sentiment Indicators

While forex reflects macroeconomic forces, stocks embody corporate performance and investor sentiment. Dutch equities, particularly within the AEX index, can serve as a gauge of broader risk appetite.

For example:

- Sectoral clues: A rally in technology stocks often signals confidence in growth, while defensive sectors like utilities tend to rise when caution prevails.

- Global spillovers: U.S. equity trends frequently influence European counterparts. A Wall Street rally may boost Dutch equities through sentiment and capital flows.

- Currency impact: As noted, euro strength or weakness directly affects companies with large export exposure, creating a two-way correlation between forex and equities.

By integrating stock analysis with forex trends, Dutch traders can identify when sentiment aligns across markets—and when divergences signal caution.

Options as a Strategic Lever

Among the most versatile tools for cross-market positioning are options. Options allow traders to hedge, speculate, or structure trades that reflect cross-asset correlations. Their flexibility lies in shaping payoff structures that respond to specific market scenarios.

Some practical examples include:

- Hedging currency exposure: A Dutch investor holding U.S. stocks may use euro-dollar options to manage forex risk.

- Protecting equity positions: Buying put options on Dutch stocks or indices offers downside protection during periods of forex volatility.

- Volatility strategies: When cross-market signals point to turbulence, traders can deploy straddles or strangles to benefit from sharp moves, regardless of direction.

Options bridge the gap between theory and execution, allowing Dutch traders to put cross-market insights into practice with precision.

Building Smarter Cross-Market Strategies

How can Dutch traders combine these elements into practical positioning? The key lies in aligning macro views with tactical execution.

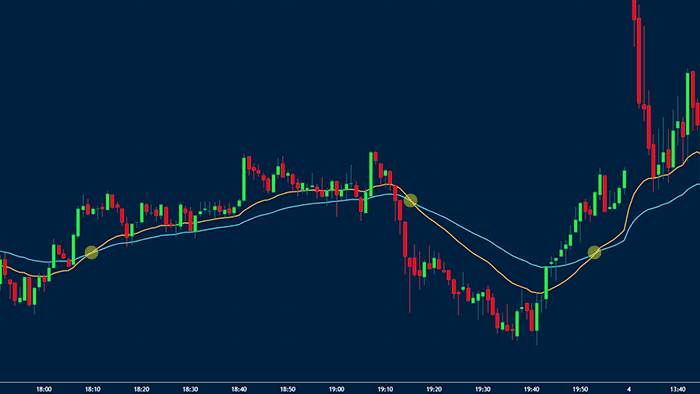

- Identify leading indicators: Forex often reacts first to central bank decisions, providing early clues for equity shifts. Tracking the euro-dollar pair alongside the AEX can highlight such dynamics.

- Look for confirmation: When both forex and equity markets signal risk-on or risk-off sentiment, conviction in a trade increases. Divergence may warrant caution.

- Use options for efficiency: Rather than overexposing capital in stocks or forex, options strategies can capture anticipated moves with limited downside.

- Stay globally aware: Dutch markets are tightly connected to global flows. Monitoring U.S., Asian, and emerging-market developments ensures a wider perspective on correlations.

A trader might, for example, anticipate euro weakness from ECB policy, expect Dutch exporters to benefit, and use call options on selected AEX stocks to position for upside with controlled risk.

Conclusion

For Dutch traders, the ability to combine forex, stocks, and options is more than a diversification strategy—it’s a way to trade with context. Correlations reveal how capital flows, sentiment, and policy decisions link markets together, offering signals that single-market analysis may overlook.

By mastering these connections, traders gain a sharper edge: anticipating moves, hedging risks, and crafting positions that reflect a global perspective. The future of smart trading lies in integration, not isolation. For those willing to embrace cross-market correlations, the reward is a toolkit equipped for resilience and opportunity in equal measure.

More Stories

Design Considerations for Hermetic Feedthrough in Industrial Systems

Things you must know before becoming an insurance agent

Expert Professional Services Tailored to Your Unique Needs